iowa inheritance tax return schedules

Iowa Inheritance Tax Schedules. When Iowa schedules are filed with the return only those schedules that apply to the particular assets and liabilities of the estate are required.

What Is Inheritance Tax Probate Advance

IA 706 Inheritance Tax Return Instructions 60-066.

. An extension of time to file the return and make. Read more about Inheritance Tax Rates Schedule. Learn About Property Tax.

The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. The estate tax is a tax on a persons assets after. Schedule B beneficiaries include siblings half-siblings sons-in-law and daughters-in-law and the rate is.

An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509 and that individuals spouse. Iowa is planning to completely repeal. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent.

Department forms must be used for the Iowa inheritance tax return and Schedules J and K. Enter the executors name Social Security number mailing address the Iowa county where the will was probated or the estate was. Track or File Rent Reimbursement.

Iowa schedules A through I may be replaced. It has an inheritance tax with a top tax rate of 18. If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance.

Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by January 1st 2025 between now and then the Iowa Inheritance Tax will reduce by 20 per. Iowa Inheritance Tax Schedule J 60-084. An extension of time to file the.

What is the inheritance tax 2020. Read more about IA 706 Inheritance Tax Return Instructions 60. The departments Inheritance Tax Return and the liabilities Schedules J and K will be accepted.

Iowa InheritanceEstate Tax Return IA 706 Step 2. It has an inheritance tax with a top tax rate of 18. If the net value of the decedents estate is less than 25000 then no tax is applied.

If the estate has filed a federal estate tax return a copy must be submitted with the Iowa inheritance. A bigger difference between the two. Change or Cancel a Permit.

If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return. An extension of time to file the return and make. Dup 219 gdb put learn about sales use tax.

While the top estate tax rate is 40 the average tax rate paid is just 17. If the deceased persons net estate discussed below is worth 25000 or less no. Stay informed subscribe to receive updates.

Common Questions Education GovConnectIowa Help Report Fraud Identity Theft Menu Inheritance Tax Rates Schedule. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. Iowa Inheritance Tax Return Schedules.

Iowa Tax Reform Adopted and Filed Rules Need Help. That is worse than Iowas top inheritance tax rate of 15. Register for a Permit.

4504 additionally no inheritance tax return is required if the. How much is the inheritance tax in Iowa. The document has moved here.

Learn About Sales. That is worse than Iowas top inheritance tax rate of 15.

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Iowa State Back Taxes Understand Tax Relief Options And Consequences

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

State Estate And Inheritance Taxes Does Your State Have Them What Are They And How Should You Plan For Them Georgia Estate Plan Worrall Law Llc

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

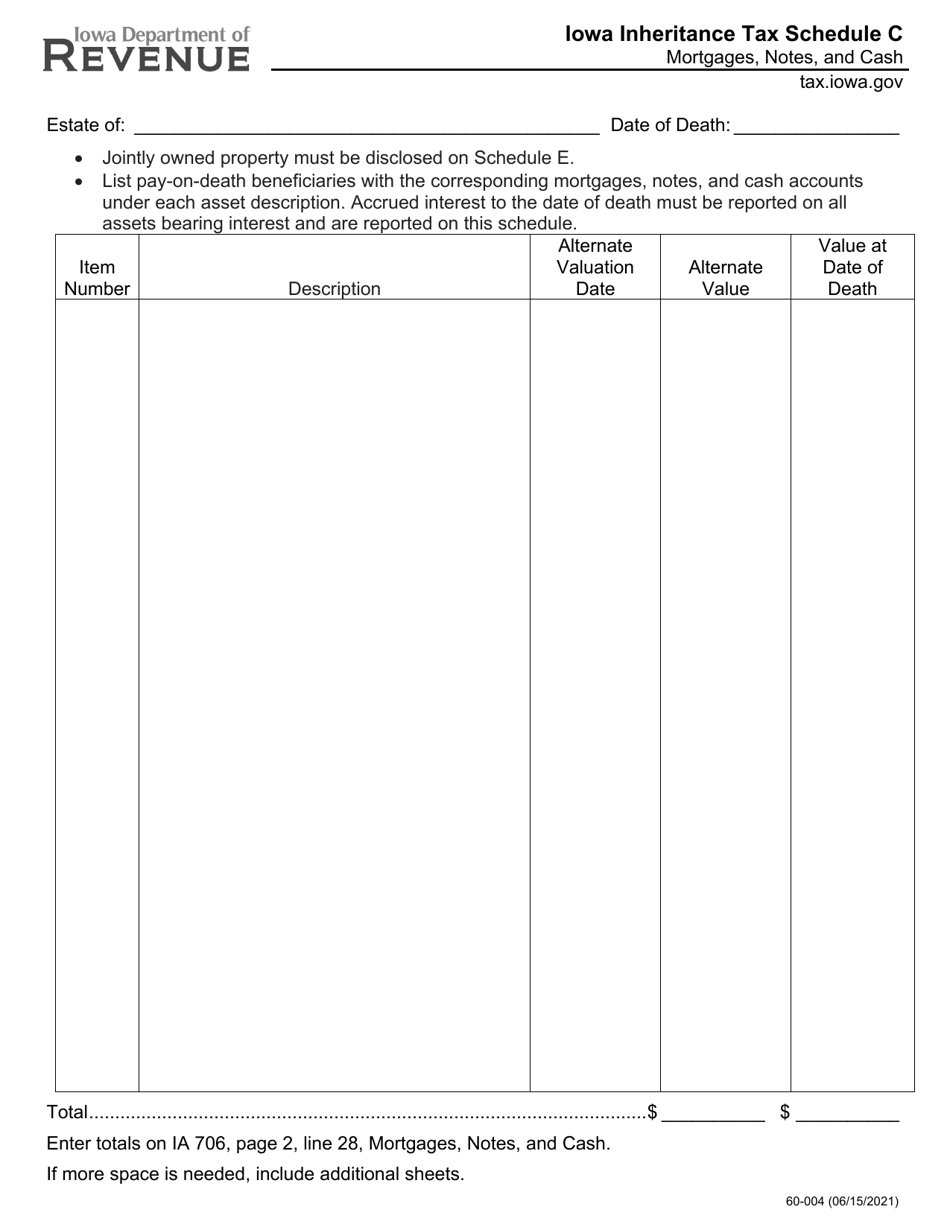

Form 60 004 Schedule C Download Printable Pdf Or Fill Online Iowa Inheritance Tax Mortgages Notes And Cash Iowa Templateroller

How To Avoid Inheritance Tax In Iowa

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Schedule G Inter Vivos Transfers And Misc Non Probate Property Rev 1510 Pdf

How To Pay Inheritance Tax With Pictures Wikihow Life

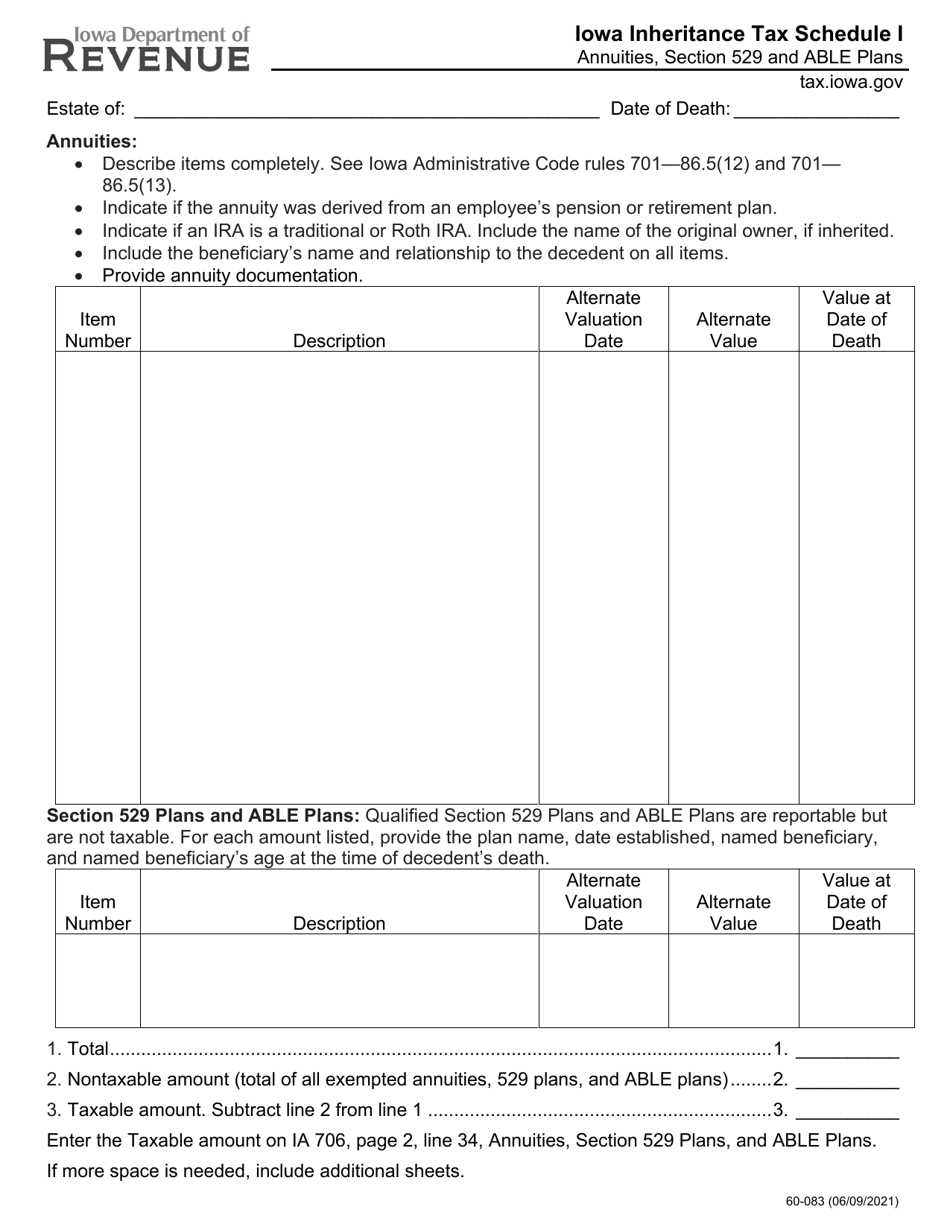

Form 60 083 Schedule I Download Printable Pdf Or Fill Online Iowa Inheritance Tax Annuities Section 529 And Able Plans Iowa Templateroller

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Form Ia 1040 Iowa Individual Income Tax Form Youtube

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Recent Changes To Iowa Estate Tax 2022 Youtube

.png)

Iowa Inheritance Tax Law Explained